Buying your first home is exhilarating. But, navigating real estate financing can be intimidating. Whether it’s a family home or an investment opportunity like DHA Gandhara, knowing about real estate financing is essential to ensure a hassle-free process. This piece of advice will help you know the financial terrain better and take a well-informed decision.

1. What is Real Estate Financing?

Real estate financing refers to the process of arranging funds to pay for the property. It mainly pools personal savings with external funding sources such as banks or financial institutions to make sure that the cost can be spread out and feasibly paid off in manageable payments.

For first-time house buyers, it is very important to know some of the terms used in real estate financing, down payment, interest rates, and tenure on a loan.

2. Financing Options Available

There are plenty of financing options available, and it will depend on your financial condition and goals. Here are the most common ones:

a. Mortgage Loans

These are the most general forms of financing. You borrow money from a bank or financial institution to buy a property, and you pay this loan over time, with interest. Mortgages require down payments typically at 10-25% value of the property.

In DHA Gandhara, reputable banks usually have mortgage packages for buyers like these, residing in such an upscale project.

b. Government Programs

Many countries provide first-time homebuyers with financial assistance programs that offer anything from lower interest rates, subsidies, or tax credits. If qualified, these programs will substantially reduce your overall costs.

c. Developer Financing

In some real estate projects by DHA Gandhara, direct installment plans are available through the developer. Such plans are accessed mainly with easier options of flexible payments to manage for a new buyer.

3. Key Financial Terms to Understand

a. Down Payment

The amount you pay as the initial on the price of the property. More down payment will decrease your monthly installments and total burden of loan.

Db. Interest Rate

Percentage of charge over the loan amount. Fixed rate remains same for the entire loan tenure while variable rates keeps on changing as per the market conditions

c. Loan Tenure

Length of time the loan is to be repaid. Longer the tenure smaller your monthly installments but more interest paid as a whole.

d. Debt-to-Income Ratio

This is the ratio of monthly payments of your debt compared to your income. The banks take this ratio to decide how capable you are of paying off the loan amount.

4. How to Obtain Financing for Your First Property

Step 1: Evaluate Your Financial Condition

You should take stock of how much you have saved, your monthly income, and debts already incurred. These will help you to determine what you can afford without straining your finances.

Step 2: Research the Property

Most important for a project like DHA Gandhara Islamabad would be knowing the complete cost, including the amount of cost in registration fees and taxes. This would also ensure that you do not later face any surprise expenses.

Step 3: Compare Loan Options

Compare interest rates, as well as terms and other fees among the banks and institutions and find the best possible deal.

Step 4: Prepare Your Documents

Typically, you’ll need to provide the following documents when applying for financing:

Proof of income

Bank statements

Employment verification

Property documents (provided by the seller or developer)

Step 5: Apply for the Loan

Submit your loan application with all the required documents. Once approved, you’ll receive the loan amount to complete the property purchase.

5. Why Choose DHA Gandhara as a First-Time Buyer?

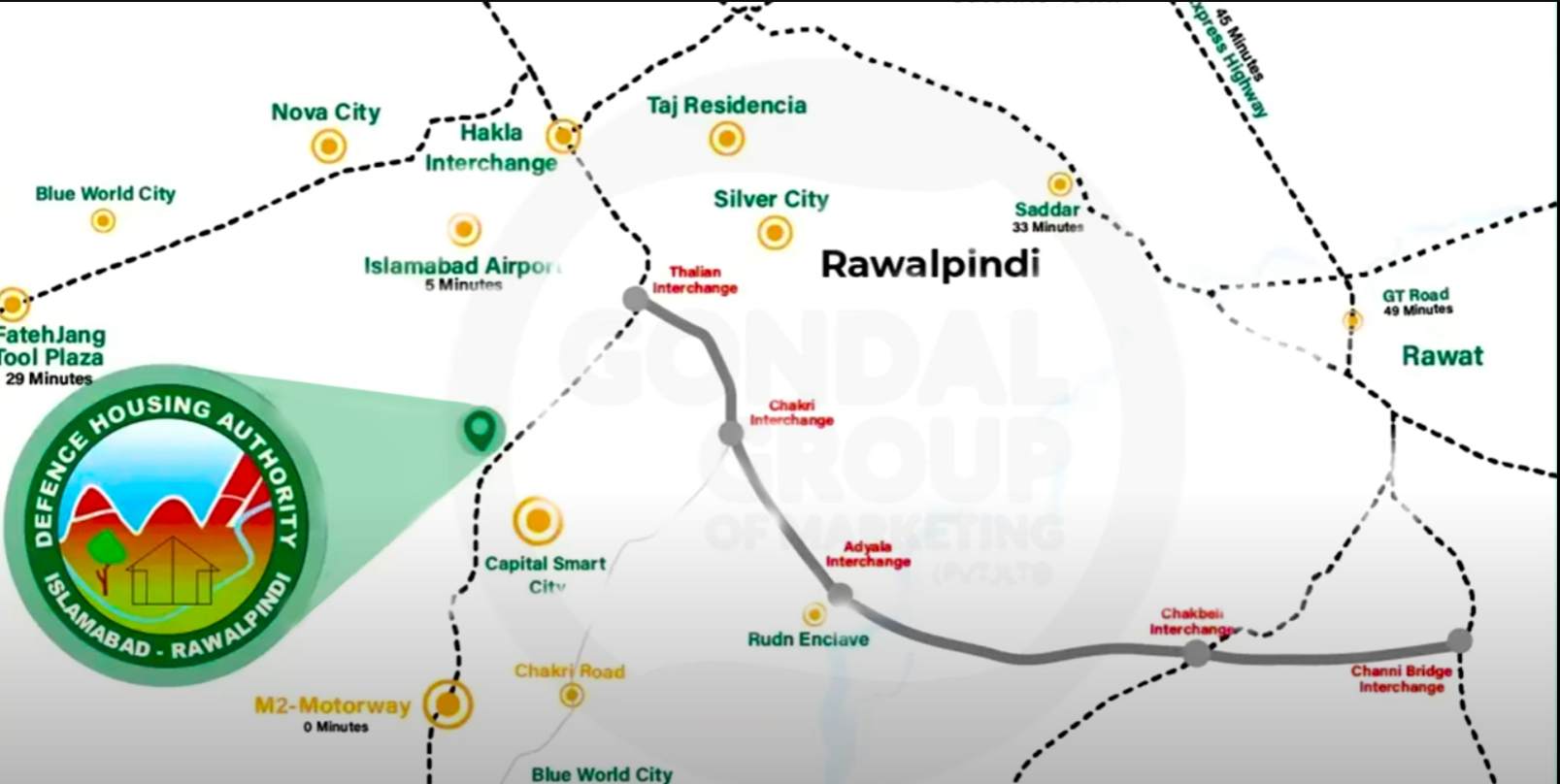

The DHA Gandhara project is an excellent option for the first-time property investors. Strategically located and having modern infrastructure, safe surroundings, make this project a fine investment. Here’s why financing a property in this project would be worth considering:

a. Flexible payment plans

DHA Gandhara allows flexible installment plans; hence, it makes possible for various buyers to possess one. In several cases, the developer allows payments over some years to reduce the financial burden.

b. High Resale Value

Properties in DHA Gandhara have a track record of appreciation in value. This means that your investment is both secure and likely to yield good returns.

c. Secure and Modern Lifestyle

The project has been designed to cater for the retiree, families, and young professionals, keeping in mind their lifestyle by offering parks, commercial areas, and healthcare facilities.

d. Association with Reputed Banks

Almost every bank has partnered with DHA Gandhara to offer individual loan deals, and thus, the whole buying process becomes much easier for first-time buyers.

6. First-Time Buyer Tips

a. Be Careful to Get a Property Within Your Pocket

One tends to get swept away by seeing great, luxurious properties. Remember to get a property that falls into your pocket comfortably.

b. Account for Other Costs

Do not ignore other costs like property taxes, maintenance charges, and insurance. All these add up meaningfully.

c. Build an Emergency Fund

Save for unexpected expenses due to repairs or market fluctuations.

d. Professional Guidance

Seek help from trusted real estate agents and financial advisors who may guide through the process. They can support your decision-making on market trends and suggest the best deals for you.

Conclusion

Real estate financing may seem intimidating, but there is always a way to make it manageable and rewarding with the right knowledge and planning. Projects like DHA Gandhara present excellent opportunities for first-time buyers in terms of acquiring a modern and secure lifestyle with flexible financing options. Having assessed your finances, understood the terms, and possibly having gained some expert advice, you would be confident enough to embark on your journey to owning your first property.