With a record number of investors trading online in India, a demat account has become a vital tool. So, what is a demat account? It provides a convenient way to buy, sell, and hold securities electronically, eliminating the need for physical share certificates.

Moreover, you can manage your investments through this account by accessing it online for easy, secure, and quick transactions. Since there are various types of demat accounts to choose from, understanding the different types available can help you make informed decisions.

Benefits of Demat Accounts

Before getting into the specifics of different types of demat accounts, let us first take a look at the common benefits they provide:

1. Convenience

All types of demat account provide the convenience of electronic storage of securities for trading online. You can manage your portfolio from anywhere and at any time using the web portal or mobile app of the broker.

2. Security

In a demat account the risk of loss, theft, or damage associated with physical certificates is eliminated. The electronic format ensures the safety of investments.

3. Cost-Effectiveness

Different demat accounts have varying fee structures. For instance, BSDA accounts offer lower charges for small investors. Choosing the right account based on one’s trading activity can help manage costs effectively.

4. Efficiency

Demat accounts streamline the process of trading online. They eliminate the need for manual intervention and reduce transaction times, making trading more efficient.

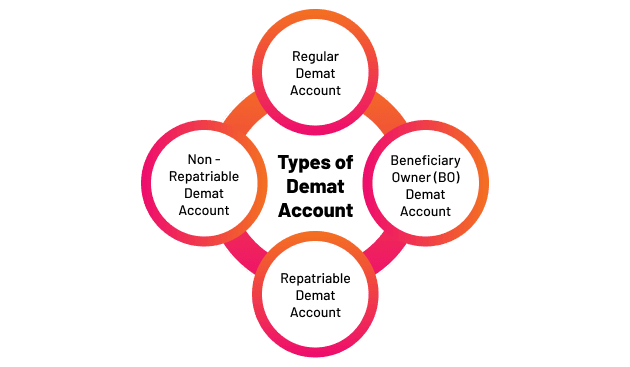

Types of Demat Accounts

Now, let us take a look at different types of demat accounts that you can choose from, if you meet the eligibility and if they serve your trading needs:

1. Regular Demat Account

This is the most common type of demat account used by investors. It is ideal for individuals or Hindu Undivided Families (HUF) who wish to hold and trade securities like stocks and bonds. A regular demat account is linked to a trading account, allowing investors to buy and sell shares seamlessly.

It provides access to various securities and is suitable for most retail investors. Within this, you can have a full-service demat account that offers a higher level of personalisation and support, or choose a basic one.

2. Basic Services Demat Account (BSDA)

The BSDA is a type of demat account with lower charges and minimal requirements. It is designed for small investors who wish to hold a limited number of securities. The BSDA offers reduced annual maintenance charges (AMC) and is ideal for individuals who are starting with a smaller portfolio or those who trade infrequently. There are several discount brokers for trading online with a basic demat account.

3. Repatriable Demat Account

This type of account is specifically designed for Non-Resident Indians (NRIs) who want to invest in Indian securities.

A repatriable demat account allows NRIs to transfer funds from their Indian investments to their foreign accounts, subject to regulatory norms. It offers flexibility for international investors who want to participate in the Indian stock market while maintaining the ability to repatriate their funds.

4. Non-Repatriable Demat Account

By using a non-repatriable demat account, NRIs can invest in Indian markets but cannot transfer funds abroad. This type of account restricts the transfer of funds to foreign accounts, making it suitable for NRIs who wish to invest in India but do not need to repatriate their earnings.

5. Corporate Demat Account

This account is designed for companies and businesses rather than individual investors. A corporate demat account allows organisations to hold and manage their securities, such as shares and bonds, in electronic form. It simplifies corporate transactions and record-keeping, making it easier for businesses to manage their investments and comply with regulatory requirements.

Choosing the Right Demat Account

Selecting the right demat account for trading online depends on your individual needs and goals. Factors to consider include the type of securities to be held, online trading frequency, and whether you are an NRI or a corporate entity.

For most retail investors, a regular demat account suffices, while NRIs may need to decide between repatriable and non-repatriable accounts based on their investment goals.