Introduction

In today’s financial landscape, a good credit score is more than just a number. It’s a key that opens doors to various financial opportunities, including low-interest loans, premium credit cards, and better terms on mortgages. Achieving the best CIBIL score is crucial if you want to enjoy these benefits. This article will provide you with a comprehensive guide on how to achieve the best CIBIL score, and we’ll also discuss how to check your credit score online. Ensuring a good CIBIL score is a continuous process, and understanding this process can save you significant money in the long run.

Understanding CIBIL Score

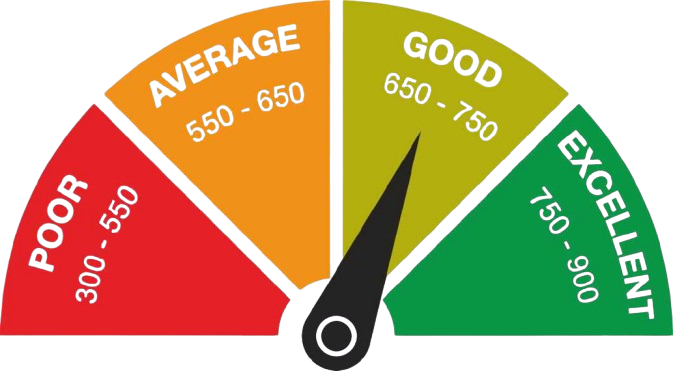

A CIBIL Score is a three-digit numeric summary of your credit history, derived from the credit report managed by TransUnion CIBIL (Credit Information Bureau (India) Limited). The score ranges between 300 and 900, with a score above 750 usually considered good by lenders. The higher your score, the better your creditworthiness in the eyes of lenders. It directly influences the interest rates you are offered. Therefore, achieving the best CIBIL score can help you obtain low-interest loans, saving you considerable amounts over the life of the loan.

How is CIBIL Score Calculated?

To achieve the best CIBIL score, it’s important to understand the factors that impact it. Here are the critical components:

- Payment History (35%): Your repayment behavior is the single most crucial factor. Late payments, defaults, and settlements negatively affect your score.

- Credit Utilization (30%): This is the ratio of credit card balances to credit limits. High utilization indicates higher risk, potentially lowering your score.

- Length of Credit History (15%): A longer credit history provides more data points, aiding in a more accurate score calculation. It considers the age of your oldest account and the average age of all your accounts.

- Credit Mix (10%): Diversified credit—involving both secured (like home loans) and unsecured credit (like credit cards)—can positively influence your score.

- New Credit (10%): Frequent credit inquiries and new credit accounts can indicate financial trouble, hence negatively impacting your score.

Steps to Achieve the Best CIBIL Score

- Timely Payment of EMIs and Credit Card Bills

The most fundamental step in achieving the best CIBIL score is timely payment of all your EMIs and credit card bills. Timely payment not only ensures that you avoid penalties but also demonstrates financial discipline. Set up automatic payments and reminders to ensure you never miss a due date.

- Maintain Low Credit Utilization Ratio

Keeping your credit utilization ratio below 30% is advisable. If your total credit limit is ₹1,00,000, try to maintain your outstanding balance below ₹30,000. High credit utilization indicates that you rely heavily on credit, which can be a red flag for lenders.

- Diversify Your Credit Portfolio

Having a mix of credit accounts—such as a combination of credit cards, personal loans, and home loans—can be beneficial. It shows lenders that you can manage different types of credit responsibly.

- Avoid Frequent Loan Applications

When you apply for credit, lenders make hard inquiries on your report. Frequent inquiries within short periods can lower your score. Apply for new credit only when necessary.

- Correct Errors in Your Credit Report

Errors on your credit report can significantly impact your CIBIL score. These errors could be due to inaccuracies in your personal information, incorrect account details, or delayed updates from lenders. Regularly check your credit report and dispute any inaccuracies you find.

- Limit the Closure of Old Credit Accounts

Your credit history length influences your CIBIL score. Closing old accounts shortens your credit history, which can negatively impact your score. Keep your oldest accounts active to maintain a longer credit history.

- Opt for Long-Term Loans Over Short-Term Loans

While short-term loans might seem like a quick solution, opting for longer-term loans can be more beneficial for your CIBIL score. Long-term loans typically have lower EMIs, which are easier to manage, reducing the risk of missed payments.

- Refrain from Over-Borrowing

Only borrow what you need and can comfortably repay. Over-borrowing can lead to high debt, making it difficult to keep up with repayments and negatively impacting your CIBIL score.

How to Check Your Credit Score Online

In order to monitor and improve your CIBIL score, it’s essential to know how to check your credit score online. Regular checks help you keep track of your score and identify areas for improvement. Here’s a simple guide on how to check your credit score online:

- Visit the CIBIL Website: Go to the TransUnion CIBIL website.

- Register/Log In: If you don’t have an account, you’ll need to register by providing essential details such as your name, Date of Birth, and PAN number. If you have an account, simply log in.

- Fill in Necessary Details: Provide additional information such as your address, phone number, and email ID.

- Answer Validation Questions: You may be asked to answer a few questions related to your credit history for verification purposes.

- View Your Credit Score: Once verified, you can view your credit score and report online.

You can also use other third-party websites and apps like CreditMantri, BankBazaar, and PaisaBazaar, which offer free credit score checks. By regularly checking your credit score online, you can ensure that you are on the right path toward achieving the best CIBIL score.

Monitoring and Maintaining Your CIBIL Score

Achieving the best CIBIL score is not a one-time task; it requires ongoing effort and monitoring. Here are some tips for maintaining your score:

- Regularly Review Your Credit Report

Make it a habit to review your credit report at least twice a year. This regular check helps you to spot inaccuracies or any fraudulent activities early and take corrective action.

- Set Financial Goals and Budget

Creating and sticking to a budget can ensure that you always have funds to meet your financial obligations. Establish financial goals like paying off high-interest debt or setting aside an emergency fund.

- Use Credit Wisely

Even if you have access to a significant credit limit, try to use only what you can repay comfortably. Making small, manageable charges and paying them off each month is an effective strategy.

- Stay Informed About Financial Products

The financial market is ever-evolving, with new products and services frequently being introduced. Staying informed can help you choose the right kind of credit that suits your needs and financial situation.

- Engage with Financial Advisors

If you find it challenging to manage your credit score or have specific financial goals, seek advice from financial advisors. They can offer tailored strategies to help you maintain or improve your CIBIL score.

- Be Cautious with Joint Accounts

While joint accounts can be beneficial, be mindful of the other person’s financial behavior. Any negative activity on a joint account also affects your CIBIL score.

Download Bajaj Finserv App for Easy Credit Score Checks

To conveniently track your financial health, download Bajaj Finserv App for access to multiple financial tools. The app makes it easy to manage loans, pay bills, and more. Wondering how to check credit score online? The app provides a quick, secure way to view your credit score anytime, helping you stay financially prepared.

Conclusion

Achieving the best CIBIL score is a gradual process requiring diligent financial habits and regular monitoring. By understanding the factors that influence your score and taking proactive steps to manage these factors, you can significantly improve your CIBIL score. Regularly checking your credit score online can keep you informed of your progress and identify areas needing improvement.

Remember, a high CIBIL score is your gateway to a plethora of financial benefits, including low-interest loans, better credit card offers, and favorable mortgage terms. Investing time and effort in managing your credit score effectively is an investment in your financial future.

By adhering to these guidelines and continuously monitoring your credit behavior, you can achieve and maintain the best CIBIL score and enjoy the numerous financial advantages that come with it. So, start today—make timely payments, manage your credit wisely, and regularly check your credit score online to keep track of your progress. Your future self will thank you for the financial freedom and opportunities you’ll reap as a result.