The biopharmaceuticals market, valued at USD 438.79 billion in 2023, is a thriving sector expected to nearly double in size by 2032. This explosive growth is driven by the increasing demand for novel treatments to combat chronic diseases, the rapid pace of technological advancement, and strategic investments by major pharmaceutical players. Let’s delve deeper into the critical elements shaping this industry.

1. Understanding Biopharmaceuticals: Why They’re a Game Changer

Biopharmaceuticals are drugs produced using biotechnology methods that utilize biological sources such as proteins, nucleic acids, or living cells to treat a range of diseases. Unlike traditional chemical-based drugs, biopharmaceuticals offer highly specific mechanisms of action, enabling targeted treatment for complex diseases such as cancer, autoimmune disorders, and genetic conditions. This precise targeting often results in fewer side effects and improved patient outcomes, making biopharmaceuticals indispensable in modern healthcare.

2. Major Trends Driving the Biopharmaceutical Market

a. Surge in Research and Development (R&D) and Technological Advancements

- Gene and Cell Therapy Breakthroughs: With the FDA approval of CAR-T therapies and CRISPR gene-editing advancements, gene and cell therapy research is one of the most significant drivers in the biopharmaceutical sector. These therapies hold the promise of potentially curing genetic diseases, pushing the boundaries of traditional treatment.

- Artificial Intelligence (AI) in Drug Discovery: AI and machine learning are accelerating drug discovery and development by predicting molecular interactions, streamlining the trial process, and significantly reducing costs. Companies using AI in drug discovery are seeing timelines cut from years to months.

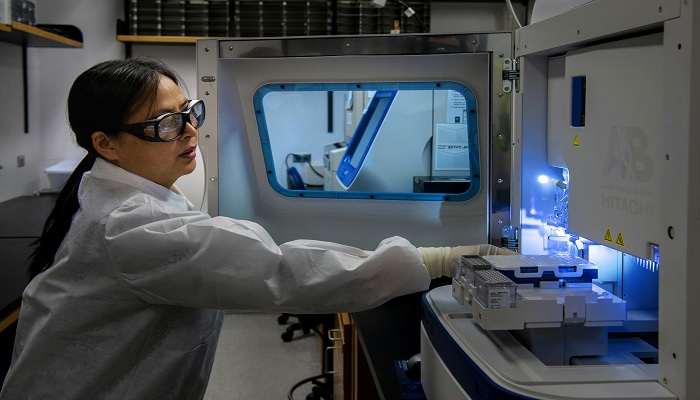

- Bioprocessing and Production Innovations: Innovations in biomanufacturing, like continuous bioprocessing, help companies scale production more efficiently, reducing costs and meeting high global demand for biopharmaceuticals.

b. Increased Focus on Chronic and Rare Diseases

- Oncology and Immunology Dominance: Biopharmaceuticals, particularly monoclonal antibodies (mAbs) and immunotherapies, have become frontline treatments in oncology. Drugs like Keytruda (Merck) and Opdivo (Bristol-Myers Squibb) have significantly improved cancer treatment outcomes.

- Rare Disease Treatments: The need for rare disease treatments has also spurred growth. The FDA’s Orphan Drug Act, which incentivizes the development of treatments for rare diseases, has led to a rise in orphan drug designations, drawing companies to invest in this lucrative segment.

c. Expanding Reach in Emerging Markets

- Growth Potential in Asia-Pacific and Latin America: Biopharmaceuticals have gained popularity in regions with increasing healthcare spending and an aging population. Rising incomes, growing healthcare infrastructure, and government support in countries like China, India, and Brazil are opening up these markets to biopharma companies.

d. Sustainability Initiatives

- Eco-Friendly Production Processes: The environmental impact of biopharma manufacturing is a growing concern. Companies are adopting sustainable practices, including reducing energy consumption, waste, and emissions, to align with global sustainability goals. These practices not only enhance brand reputation but also make production more cost-efficient in the long term.

3. Key Players and Competitive Dynamics

The biopharmaceutical market is highly competitive, with established players like Amgen, AbbVie, and Pfizer driving innovation through extensive R&D investment, partnerships, and strategic acquisitions. Here’s a closer look at some key companies and their contributions:

- Amgen Inc.: A leader in biotechnology, Amgen focuses on oncology, cardiovascular, and inflammation, with drugs like Repatha (for high cholesterol) and Enbrel (for rheumatoid arthritis) being widely prescribed.

- AbbVie Inc.: Known for Humira, one of the best-selling drugs globally, AbbVie also has a strong pipeline in oncology and neuroscience.

- Bristol-Myers Squibb: A major player in immuno-oncology, Bristol-Myers Squibb has been at the forefront of cancer treatment with its breakthrough therapy Opdivo.

These companies are increasingly investing in next-gen therapies, and mergers and acquisitions remain a dominant strategy for growth. For example, Pfizer’s acquisition of Array BioPharma and Gilead’s acquisition of Kite Pharma underscore the industry’s focus on strengthening pipelines in high-growth areas like oncology and gene therapy.

4. Key Challenges in the Biopharmaceutical Industry

a. High Costs and Complex Production Processes

- Manufacturing Complexity: Biopharmaceuticals require advanced biomanufacturing facilities, which are costly and take years to set up. Unlike chemical synthesis, biopharma production involves living cells and biological systems, making it highly complex.

- High R&D Costs: The cost of developing a biopharmaceutical drug can exceed USD 1 billion due to lengthy clinical trials, stringent regulatory requirements, and the complexity of biological compounds.

b. Regulatory Challenges

- Stringent Approval Process: Regulatory agencies like the FDA and EMA enforce rigorous approval processes to ensure safety and efficacy, which can delay the launch of new drugs.

- Navigating Intellectual Property: Patents are critical in biopharma but face challenges with biosimilars entering the market. Once patents expire, companies face competition from biosimilar drugs, which can significantly impact revenues.

c. Supply Chain and Distribution

- Cold Chain Logistics: Many biopharmaceuticals, especially vaccines and cell therapies, require cold chain logistics to maintain efficacy. This adds complexity and cost to the distribution, especially in regions with limited infrastructure.

5. Market Forecast (2024-2032): Growth Projections and Future Potential

The biopharmaceutical market is expected to grow at a CAGR of 7.6%, reaching USD 848.34 billion by 2032. This growth will be led by continuous investment in next-gen therapies, expansions in emerging markets, and advancements in biomanufacturing. Innovations in gene therapy, targeted cancer treatments, and personalized medicine will likely drive the next wave of industry growth.

6. Future Opportunities: What Lies Ahead

a. Personalized Medicine and Precision Therapies

- As genomics and proteomics advance, the industry is moving towards personalized medicine, where treatments are tailored to individual genetic profiles. This approach promises better outcomes and fewer side effects, setting the stage for the next evolution in biopharmaceuticals.

b. Innovations in Drug Delivery Systems

- Drug delivery technologies, such as nanoparticle delivery and gene-editing CRISPR-based delivery systems, are transforming how drugs interact with cells. These advancements allow more precise targeting, minimizing harm to healthy cells and improving the drug’s effectiveness.

c. Expanding Reach of Biosimilars

- Biosimilars are biologic drugs that are nearly identical to already approved reference products. With patents expiring on blockbuster biologics, the market for biosimilars is growing, providing more affordable treatment options. This not only benefits healthcare systems but also opens up opportunities for companies specializing in biosimilars.